Menu

Menu

July 27, 2021

by Peter Maloney

APPA News

July 27, 2021

The pairing of photovoltaic (PV) solar power with battery storage is growing but represents a small portion of the market and cannot be fully explained by economics, according to a new report from the Lawrence Berkeley National Laboratory (LBNL).

The report, Behind-the-Meter Solar+Storage: Market Data and Trends, found that out of the 3,200 megawatts (MW) of battery storage installed in the United States through 2020 about 1,000 MW, or 30 percent, was behind-the-meter and 550 MW of that was paired with solar power. The overwhelming majority, 80 percent, of the combined solar and storage installations were in the residential sector.

Most non-residential energy storage installations were done on a stand alone basis with only about 40 percent paired with solar power. In the utility scale, front-of-the-meter market segment, only 420 MW, or 19 percent, of storage capacity was paired with solar power.

Of all the residential photovoltaic solar systems installed in 2020, about 6 percent included storage and only 2 percent of non-residential solar systems included storage, but there were wide variations in the numbers depending on location, the report found.

Hawaii has, by far, the highest storage attachment rates of any state with 80 percent of residential and 40 percent of non-residential solar systems including storage in 2020. That market, the report says, is driven by net metering reforms that incentivize self-consumption instead of utility payments for excess solar generation.

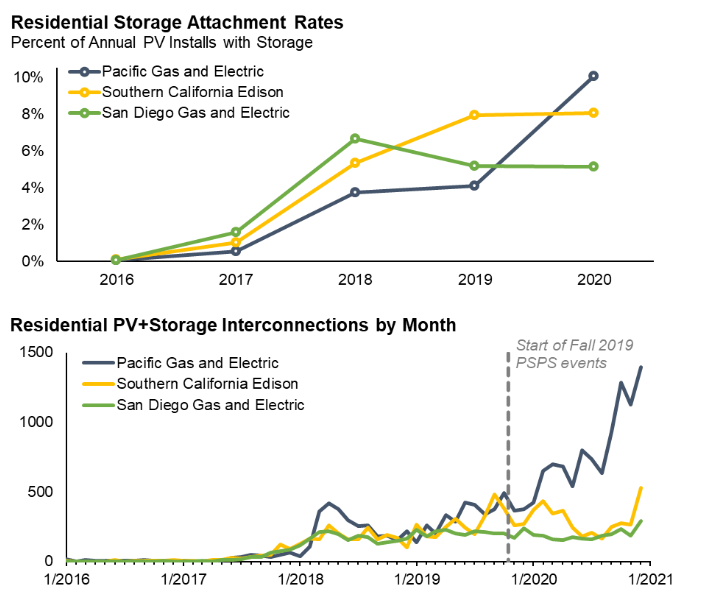

California was a distant second with 8 percent of residential and 2 percent of non-residential solar systems attaching storage in 2020, driven mostly by incentives and wildfire resilience issues, the report found.

While attachment rates are generally lower outside of California and Hawaii, some utilities, such as Salt River Project in Arizona and Puget Sound Energy in Washington, have attachment rates in the 10 to 20 percent range. In general, however, the report found that residential attachment rates have been rising while non-residential trends are uneven, but in aggregate have been “fairly flat.”

The report also found that residential adopters of solar-plus-storage systems generally have higher incomes than stand-alone PV solar adopters. In California, for instance, solar-plus-storage adopters had median incomes 66 percent higher than their area median income, while stand-alone solar adopter incomes were 41 percent higher.

Within the non-residential sector, for-profit commercial entities comprise about 70 percent of all paired non-residential systems. Schools make up a notably larger share, 25 percent, of paired solar-plus-storage systems than they do for stand-alone solar systems (8%), reflecting “a unique resilience value and relatively large loads,” the report said.

The report also used three different data sources to look at the cost of adding storage to a solar installation and found an incremental cost of adding storage to a residential PV solar system to be about $1,000 per kilowatt hour (kWh) of storage, implying an installed price premium of about $1.20 per watt of solar PV.

In addition to finding that the deployment of solar-plus-storage is locationally specific and driven by rate structures, incentive programs, and natural disaster threats, the report concluded that installed prices for behind-the-meter battery systems have generally risen or remained flat over the past few years. Increasing adoption of battery storage systems cannot, therefore, be attributed to falling retail costs alone, the authors said.

“Deployment trends partly reflect the underlying economics, but there are also some apparent disconnects,” The report’s authors said. Among the disconnects, they noted lower attachment rates in the non-residential sector than in the residential sector, divergent attachment rates across regions with similar payback, and uneconomic adoption in some markets. “Those apparent disconnects may partly reflect other sources of value beyond the direct financial benefits—including potential customer reliability benefits from backup power during outages,” the authors concluded.

Copyright © 2024 Kansas Power Pool | Designed by Custom Internet Services LLC